2024 Trends in SRT Transactions

Significant risk transfer transactions or SRTs1 are one of the fastest growing corners of the financial markets. In this update, senior associate Robyn Llewellyn in collaboration with partners Ed Parker and Neil Hamilton, consider some important trends and developments in the SRT market in 2024 - including the opening of the US market, increasing international regulatory scrutiny and updates to the UK capital framework.

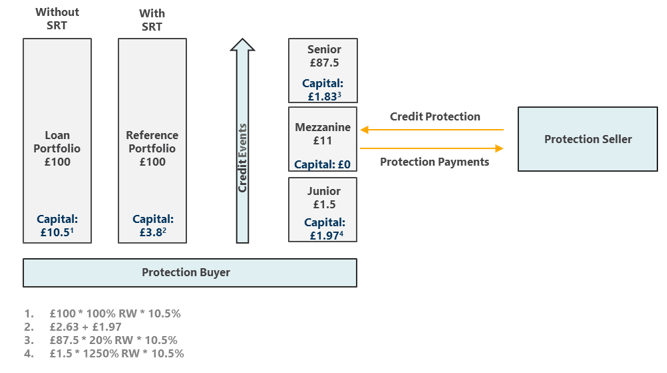

SRTs involve transferring credit risk on a reference pool of assets to investors, in return for the payment of regular interest/fees for such protection. SRTs are primarily used by banks (or "protection buyer") for capital optimisation (improving return on capital or freeing up capital for new lending), but can also be used to manage credit risk, reduce risk concentrations or reduce NPE ratios. Investors (or "protection seller") in SRTs are typically insurers, pension funds or specialist credit investors.

Global issuance of SRTs amounted to roughly $16.6 billion in the first nine months of 2024. Issuance for the whole of 2024 is on pace to reach between $28 billion and $30 billion. The size of SRTs outstanding is approximately $70 billion.2 This rapid growth stands in contrast to the more tepid growth in the traditional securitisation market over recent years.

SRTs typically take the form of synthetic securitisations (cash SRT securitisations are also possible, but less common). In these transactions, a financial contract such as a swap or credit-linked note (either issued directly by the bank or indirectly by an SPV) references a specific reference asset portfolio. The transaction is split into tranches, usually including a junior/first-loss tranche, a mezzanine tranche and a senior tranche. The protection buyer usually sells the risk on the mezzanine tranche, and retains the risk on the junior and senior tranche. The transactions may be funded, meaning the bank will receive cash at initiation of that transaction (which will be applied to write down the protected tranche if a credit event occurs), or unfunded, meaning no collateral is provided by the protection seller and the credit risk mitigation is a promise to cover defaults. Whether a transaction is funded or unfunded depends on factors such as whether the institution is looking for funding or just capital management. In US transactions, it is common for there only to be a senior and junior tranche, with the bank selling the junior and retaining the senior.

Illustrative Example

Given the pace of these developments, this update considers some important trends and developments in the SRT market in 2024.

1. Opening of US Market

The European SRT market has historically made up the vast majority of the global market – comprising as high as 85% of global issuance.3 This has been the result of early adoption of SRT into the European regulatory capital framework (in 2006 in the Capital Requirements Directive4) and a common and settled regulatory framework in the form of the Single Supervisory Mechanism and EBA guidance on SRT5.

However, US banks are increasingly using SRTs, for the same reasons as European institutions - to manage risk and support their capital ratios (and investor demand for access to the credit risk). Historically, the main structure used by US banks was directly issued CLNs (indirect SPV structures which involve CDS contracts may trigger certain legal and regulatory implications, including registration requirements with the US Commodity Futures Trading Commission).

The main reason for lethargic US issuance in the past has been regulatory uncertainty. The most common structure of bank issued CLNs (but not SPV or CDS structures) requires a formal "reservation of authority" (ROA) approval from the bank's federal regulator. And it was unclear if directly issued CLNs were eligible for regulatory capital relief (bank-issued CLNs are not technically a credit derivative or guarantee and only pledged third-party collateral could be recognised as a credit mitigant). In September 20236, the Federal Reserve clarified that regulatory capital relief is available in respect of directly issued CLNs (it has also affirmed this directly in ROA letters to several banks seeking capital relief in 2024, provided that the aggregate outstanding reference portfolio principal amount does not exceed certain limits – e.g. the lesser of $20bn and total capital). This clarification was welcomed by the market, and there has also been a significant increase in direct CDS structures. A CDS structure can provide more execution certainty as it is not subject to the ROA process, and avoids the legal pitfalls associated with SPV-issued CLNs (including Volcker rule and commodity fund requirements).

With increased US issuance following the Federal Reserve decision, the US share of the global SRT market has roughly doubled to 30%.7 S&P have reported that the increased issuance could reach an extent where it positively affects their calculations of US banks' capital adequacy calculations.8

Challenges remain. Smaller banks, with less experience with structured finance, may find it difficult to arrange such transactions and provide on-going reporting. In this context, it has been reported9 that more experienced arrangers are structuring transactions to give access to the market to smaller lenders. In addition, US regulators are scrutinising all types of SRT transactions with more vigour to ensure they are compliant with regulatory rules (the Office of the Comptroller of the Currency this year identified SRT transactions as a supervision priority).

2. International Regulatory Scrutiny10

In its twice-yearly global financial stability report11, the IMF recently identified SRTs as posing potential risks to financial stability. The first potential risk relates to financial interconnectedness, as a result of how investors may fund their positions. Protection sellers will often seek to maximise their returns by funding part of their investment with leverage (e.g. NAV lines to the protection seller or repo funding on CLNs). This leverage may come from other banks who are subject to the same capital requirements as the protection buyers. The IMF suggests that this leverage (so-called "back leverage") by banks to SRT investors could create “negative feedback loops” where the risk ostensibly being shifted off banks’ balance sheets stays within the banking system. As a result of this regulatory scrutiny, some bank protection buyers have restricted investors in their SRT transactions from using back leverage to fund their investment.

However, it seems unlikely that back leverage is correlated with the performance of the underlying assets/tranche, such that it is simply shifting the risk around the financial system. The leverage is typically provided on a full recourse, collateralised and margined basis with an equity buffer (e.g. repo with a haircut), and is underwritten by a bank according to its standard criteria (the question of whether that equity/underwriting is sufficient is a separate but related question).

3. UK capital updates for SRT transactions12

In a recent consultation paper, the Prudential Regulation Authority (PRA) has outlined several proposed changes to the regulatory capital framework for synthetic securitisations transactions (CP13/24) – as part of its efforts to restate the assimilated Capital Requirements Regulation in the PRA Rulebook. These changes are aimed at enhancing the clarity and risk sensitivity of the framework, as well as aligning it with international standards. Below is a summary of the key proposals, which the PRA hope to implement by 1 January 2026.

(i) Updated P-Factor

The "p-factor" is a capital multiplier that is applied under the securitisation regulatory capital rules to calculate risk weighted assets. It is used to ensure that the aggregate capital charge for securitisations is greater than if the assets were on an originator's balance sheet - reflecting the agency, model and other specific risks embedded in securitisations. The PRA is proposing to modify the Securitisation Standardised Approach (SEC-SA) so that, for each securitisation, firms may choose to use either the existing fixed p-factor (which is p=1 for securitisations that are not STS and p=0.5 for STS securitisations) or a formulaic p-factor, which is based on the formula used for the Securitisation Internal Ratings-Based Approach (SEC-IRBA) (itself floored at 0.5 for non-STS and 0.3 for STS).

The proposed formulaic p-factor considers transaction features including portfolio granularity and loss given default (LGD), tranche maturity and seniority, and whether or not the deal is retail, and is intended to make the SEC-SA more risk-sensitive and proportionate, potentially reducing the capital requirements for certain securitisations13 - as well as aligning these calculations more closely with the approach in the US and EU (usually p=0.5, as described below).

The European Commission has launched a wide-ranging consultation14 to assess the factors inhibiting the growth of the EU securitisation market, including the prudential treatment of securitisations for banks and insurers. The consultation does not put forward concrete proposals, but refers to a number of possible prudential reforms, including making permanent the current transitional halving of the SEC-SA p-factor.

The US continues to apply the securitisation capital requirements that preceded the Basel 3 reforms introduced in the EU in 2019 (CRD V and CRR II), and hence a p-factor of 0.5 under the standardised approach, giving its banks a competitive advantage over EU banks. While recent proposals for implementing Basel 3.1 in the US would have brought the US in line with the EU in relation to the standardised p-factor, the outcome of the US presidential election casts doubt on whether these proposals will be implemented in any form.

(ii) Use of unfunded credit protection

As mentioned above, SRT transactions may be funded or unfunded, with unfunded transactions involving credit risk mitigation which comprises an uncollateralised promise from a third party to pay when an underlying obligor defaults.

Whilst acknowledging that unfunded credit protection involves greater risk when compared to funded protection (including a potentially higher risk of late or non-payment of the credit protection and a downgrade of the protection seller which could lead to replacement), the PRA has confirmed that it should be possible for originator institutions to use unfunded credit protection to achieve SRT where the other regulatory requirements are met. The PRA will update its supervisory statement SS9/13 (Securitisation – Significant Risk Transfer) to clarify this (its policy on when it will approve an SRT application).

Firms will be expected to discuss the use of unfunded credit protection with their supervisors at an early stage and monitor risks relating to their SRT transactions in accordance with existing rules.

1 Sometimes referred to with a more cooperative tone as credit risk sharing transaction.

2 https://www.bnnbloomberg.ca/business/2024/10/21/loans-tied-to-srts-reach-1-trillion-on-record-pace-of-sales/

3 https://www.esrb.europa.eu//pub/pdf/occasional/esrb.op23~07d5c3eef2.en.pdf

4 Directive 2006/48/EC of the European Parliament and of the Council of 14 June 2006 relating to the taking up and pursuit of the business of credit institutions (recast)

5 European Banking Authority (2017), “Discussion paper on the Significant Risk Transfer in Securitisation” and (2020) “Report on significant risk transfer in securitisation under Articles 244(6) and 245(6) of the Capital Requirements Regulation”

6 Board of Governors of the Federal Reserve System (Federalreserve.gov), September 2023

7 https://www.bnnbloomberg.ca/business/2024/10/21/loans-tied-to-srts-reach-1-trillion-on-record-pace-of-sales/

8 https://www.spglobal.com/ratings/en/research/articles/241112-credit-faq-how-are-north-american-banks-using-significant-risk-transfers-13317377

9 https://www.ft.com/content/11fb7da7-d529-4e4e-a82f-df6ffbc25565?emailId=352a5dd6-93b4-43cd-ac38-a5628c7704f5&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

10 https://www.ft.com/content/11fb7da7-d529-4e4e-a82f-df6ffbc25565?emailId=352a5dd6-93b4-43cd-ac38-a5628c7704f5&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

11 https://www.imf.org/-/media/Files/Publications/GFSR/2024/October/English/execsum.ashx

12 https://beta.bankofengland.co.uk/prudential-regulation/publication/2024/october/remainder-of-crr-restatement-of-assimilated-law-consultation-paper

13 The PRA estimate that if firms choose to use the proposed option, this might reduce current total capital requirements by about £240 million – p.38.

14 https://finance.ec.europa.eu/regulation-and-supervision/consultations-0/targeted-consultation-functioning-eu-securitisation-framework-2024_en