NAV Credit Facilities: The Spectrum of Collateral Structures

Executive Summary

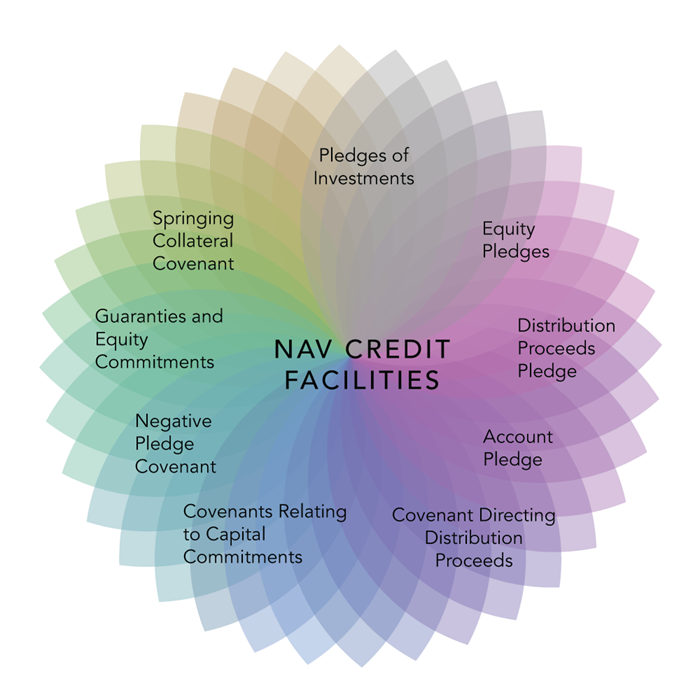

Net Asset Value (“NAV”) credit facilities1 are a tool that borrowers may use to access financing based on the value of their underlying investment portfolio. The users of these facilities are generally private equity funds, family offices, and large investors with diversified private equity holdings. Because of the structures that accompany these types of entities and constraints related to the investment portfolio, there is no one-size-fits-all approach when it comes to NAV credit facilities. Therefore, market participants should understand both the spectrum of collateral and the covenants at their disposal to effectively structure each facility to meet the borrower’s needs. In this Legal Update, we explain the most common types of collateral structures used in secured NAV credit facilities and explore why some approaches are more frequently used than others based on the borrowers’ structures and asset classes. While most NAV facilities that are secured include account pledges with related covenants, additional collateral structures include: (i) pledges of investments, (ii) equity pledges, whether of each entity in a structure or of a holding vehicle or aggregator entity, (iii) pledges of distribution proceeds and (iv) pledges of cash or securities accounts. Each structure is suited to different circumstances, depending on factors such as portfolio composition, transfer restrictions, and lender risk appetite.

Background

NAV credit facilities come in a variety of shapes and sizes—with many differences driven by the asset class of the investments, the asset pool’s concentration or diversification, the advance rate, and any debt or transfer restrictions imposed upon the assets. NAV lenders must take into account the diversity of collateral and restrictive covenant structures, and collateral packages must require flexibility to account for the limitations often presented by the asset pool. The NAV credit facility market has grown substantially in recent years, driving innovation in collateral structures to accommodate diverse borrower needs and asset types.

I. SECURITY STRUCTURES

While NAV credit facilities may be provided on an unsecured basis—particularly in deals involving borrowers whose investment pool consists of high-quality and liquid asset classes—most lenders require facilities that are at a minimum secured by a pledge of the collateral account into which distributions from the investments are funded. Due to the commercial challenges in obtaining a more fulsome collateral package (i.e., burdensome transfer restrictions, expensive diligence costs, etc.), lenders tend to require a combination of bespoke collateral pledges and restrictive covenants designed to mitigate default risks and preserve the lenders’ seniority in terms of recovery on the investments or distributions from the investments.

Before diving into the most common combinations of security structures, and which circumstances might warrant their use, the below sets forth some of the primary forms of collateral and restrictive covenants commonly used in NAV credit facilities.

- Components of a Collateral Pool

- Pledge of Investments: Loan parties pledge the investments held by the borrower or its subsidiaries.

- Equity Pledges

- Equity Pledge: Loan parties pledge the equity interests it owns directly or indirectly in each entity sitting between the borrowers and the underlying asset (including equity in any holding company and the ultimate portfolio company, as applicable). This may include a full pledge on these entities, if wholly owned, or a partial pledge reflecting the actual look-through ownership that the borrower has in such entities.

- Holding Vehicle or Aggregator Equity Pledge: Loan parties pledge the equity interests in either (a) a subsidiary entity acting as an aggregator that, directly or indirectly, holds ownership of all, or the desired portion, of the underlying assets or (b) in multiple subsidiary entities that each own a direct equity interest in an underlying asset.2

- Distribution Proceeds Pledge: Loan parties grant a security interest in the right to income, distributions, and other cash flows from underlying portfolio investments, which may include negotiated disposition proceeds from the sale of investments or equity held (such cash flows, “Distribution Proceeds”).

- Account Pledge: Loan parties (which may include holding vehicles or aggregators if wholly owned) pledge their accounts—this can either take the form of a pledge of (a) all accounts, (b) a specific securities account, or (c) only the collateral accounts used to collect Distribution Proceeds. Additionally, if the account is a securities account, and the assets are held in such account, one may obtain a lien on the securities entitlement, which may provide the ability to obtain an indirect pledge on the assets.

- Forms of Restrictive Covenants

- Covenant Directing Distribution Proceeds: Lenders often rely on a covenant in the loan documents requiring borrowers to deposit any Distribution Proceeds into a pledged deposit account.

- Covenants Relating to Capital Commitments:

- Covenant to Reserve Uncalled Capital Commitments: Lenders may require a covenant in the loan documents requiring the loan parties to maintain sufficient uncalled capital commitments from their investors to repay any outstanding debt and any downstream capital commitments to pay for obligations required by the terms of its investments.

- Covenant to Call Capital: Lenders may require a covenant in the loan documents requiring the loan parties to call capital during an event of default to repay any outstanding debt provided that such covenant does not interfere with any subscription credit facility that may exist.

- Negative Pledge Covenant: Lenders may rely on covenants in the loan documents prohibiting the borrowers from pledging their assets to a third party. Additionally, a so-called “double negative pledge” may be included to provide additional comfort.3

- Springing Collateral Covenant: Lenders may rely on a covenant in the loan documents requiring loan parties to pledge additional collateral if their loan-to-value (“LTV”) ratio falls below a certain predetermined threshold.

- Guaranties and Equity Commitments: Lenders may require that a financially viable parent entity of a loan party either (i) guaranties such loan party’s obligations or (ii) agrees to contribute capital or provide other financial support in favor of a loan party.

II. UNDERSTANDING EACH FORM OF COLLATERAL AND RESTRICIVE COVENANTS

Each category of collateral, restrictive covenant, or other form of credit support listed above has its own benefits and considerations, and understanding these nuances allows market participants to effectively structure NAV credit facilities to meet the specific circumstances at hand. The specific combination of collateral and restrictive covenants that a lender requires is driven largely by the borrower’s unique characteristics, the borrower’s anticipated creditworthiness, and the asset pool’s nature and limitations. While a particular collateral and restrictive covenant structure might work in one transaction, it may be inappropriate or cost prohibitive in another.

- Pledge of Investments

While a direct lien on the investments held by the borrower or its subsidiaries may be the ideal form of collateral, it is not always feasible, either due to the type of investments held by the borrower or because the investments are not wholly owned by the borrower or its subsidiaries.

Generally, certain types of investments lend themselves to pledges more easily, such as loans or other debt investments, and we often see liens provided on the loan portfolios of credit funds. Other types of investments, such as private equity and hedge fund interests, real estate assets, or infrastructure assets, may be more difficult to pledge directly due to (a) investment-level debt already enlisting such investments as collateral or containing negative covenants preventing such pledges or (b) the documents governing such investments preventing such pledges without the consent of the issuer of such investment.

Another factor limiting a borrower’s ability to pledge its investments may be that it does not wholly own its investments, but only owns a partial interest in a holding vehicle or joint vehicle that may or may not be sponsored by the borrower, and therefore requires consents from co-owners or issuers that would be reluctant to provide such consents for tax, regulatory, or commercial reasons, including concerns about the creditworthiness of the holder of such investments (particularly where the investments require ongoing obligations to pay in funds from an investor).

A pledge of investments is therefore most often possible where (a) there is no indebtedness at the level of the investment which prevents such pledge, either because the investment is pledged to support such investment or the covenants relating to such investment do not prevent such pledge and (b) the borrower is affiliated with the sponsor of the investments and thus able to provide the consents necessary to enable a pledge of such investments.

- Pledge of Equity

Other than a direct pledge of investments themselves, equity pledges are the most robust form of collateral in NAV credit facilities, offering lenders the most control in default scenarios.4 Pledges of equity can give lenders flexibility in a foreclosure scenario post-event of default. By having the ability to foreclose on the equity of an asset, lenders can foreclose on or vote the equity themselves, thereby directing the activities of the pledged entity or potentially transferring the asset to a third-party.5

(i) Equity Pledge. In some cases, particularly if a significant portion of the portfolio is concentrated in a single investment, lenders may require a pledge of all equity in each entity sitting between the borrower and the underlying asset (including any holding companies and the ultimate portfolio companies, as applicable).

Pledges of equity in each entity in the structure grant lenders significant flexibility in liquidation post-event of default. Lenders may choose to sell the overall portfolio or break off and sell individual assets or parts of the structure to ensure sufficient returns to repay any outstanding debt.

A direct pledge of equity in the portfolio investment may also be beneficial because it offers a claim on the equity of the borrower and is closer to the level of the investments, reducing the risk associated with potential dilution or “leakage” of assets or funds from the structure.

(ii) Holding Vehicle or Aggregator Equity Pledge. Alternatively, lenders may require a pledge of the holding vehicle’s or aggregator’s equity, particularly if the pledging fund possesses a highly diversified portfolio, borrowers may pledge their equity interests in either (a) a subsidiary aggregator entity that directly or indirectly holds all, or the desired portion, of the underlying assets on behalf of such borrower or (b) multiple subsidiary entities that each own a direct equity interest in an underlying asset.6 If the borrower is a subsidiary holding vehicle of a larger fund, a pledge of all equity in the borrower is typically required.

A pledge of such aggregator vehicles or holding vehicles provides lenders with a liquid and versatile form of collateral that can be sold off wholesale to a third party if needed. Additionally, holding equity in an aggregator entity gives lenders potential indirect control over the underlying assets, offering greater flexibility in managing and leveraging their collateral position, thereby enhancing their risk mitigation strategy.

In either case, lenders would be lending against the net asset value of the underlying assets held through the pledged entities and, in the event of a borrower default, lenders would rely on the sale of the pledged equity of the pledged entities to recover on their loan.

A key limitation of equity pledges is that any defaults with respect to indebtedness at the level of the investment or any holding vehicles will prime the ability to obtain value relating to the equity pledged in favor of a NAV lender and the availability of distributions. Other key limitations of equity pledges, and the steps lenders can take to mitigate their effects include:

|

KEY CONSIDERATIONS |

POTENTIAL MITIGANTS |

|

Indebtedness at the level of the investment have pledged such equity to support such indebtedness or prevent such a pledge. The governing documents of the underlying portfolio companies may include direct or indirect transfer restrictions.7 |

None, unless appropriate consents are received and, even if provided, may be a second lien. Ensuring that the appropriate consents are received to facilitate such transfer or pledge. Haircutting the advance rate for the asset, requiring a concentration limit for all such assets or removing the asset borrowing base completely. Carving out of the pledge any asset that has a transfer restriction and relying on other collateral/covenants for those assets. |

|

The governing documents of the pledged subsidiary holding vehicle can sometimes include pledge or transfer restrictions. |

Amending such governing documents to permit a sale process and allow a third party to come in as the sole limited partner/sole member post-event of default. |

|

Portfolio investments can sometimes be structured as loans, rather than equity, which may be harder to sell in a foreclosure. |

Adjusting the concentration limit or haircut on, or the value assigned to, any debt portfolio investments. |

|

The borrower may own less than 100% of a holding vehicle or may not own a majority of a holding vehicle. |

If a majority of a holding vehicle is owned by the borrower (or controlled by the sponsor of the borrower) one may be able to have the general partner of the holding vehicle agree to liquidate assets of such holding vehicle on a pro rata basis and distribute proceeds to a borrower as liquidating distributions. |

- Pledge of Distribution Proceeds

In certain instances, lenders are comfortable foregoing equity pledges if they obtain a pledge by the fund of its rights to receive Distribution Proceeds from underlying portfolio investments, coupled with a pledge of an account into which such Distribution Proceeds are contractually required to be deposited.

The key limitations of a pledge of Distribution Proceeds, and the steps lenders can take to mitigate their effects, include:

|

KEY CONSIDERATIONS |

POTENTIAL MITIGANTS |

|

The uncertainty of these cash flows (either because of the adverse effect of market conditions or investment performance, or because the borrower chooses to sit on the asset to avoid having to pay out). |

Requiring more regular financial reporting, more comprehensive and higher percentage cash sweeps, and stricter financial covenants tied to performance metrics and loan-to-value ratios. Lenders may also require forced amortization of term loans such that a required amount of loans is to be repaid each year regardless of cash flows. Requirements to use good faith efforts to sell portfolio investments to generate cash flows if requested post-event of default. Implementing cash sweep mechanisms to capture Distribution Proceeds more frequently. |

|

The governing documents of the underlying portfolio companies (or an intermediary entity sitting between the portfolio company and the pledgor) may include direct or indirect transfer restrictions. |

Ensuring that the appropriate consents are received to facilitate such pledge. Haircutting the advance rate for the asset, requiring a concentration limit for all such assets, or removing the asset borrowing base completely. Carving out of the pledge any asset that has a transfer restriction and relying on other collateral/covenants for those assets. |

|

In a scenario where there is an insolvency proceeding with respect to the borrower, future payment streams from underlying investments may be excluded from the collateral of the lenders by a court in an insolvency proceeding on the basis that such payments are not yet due and payable or are not yet earned at the time of the filing of the bankruptcy petition. |

This legal risk is hard to mitigate, but other protections, including strong negative covenant packages, can limit the likelihood of competing claims. Restructuring counsel in each relevant jurisdiction can analyze potential issues that may arise from a pledge of such future payment streams under applicable bankruptcy laws. |

- Accounts and Covenant to Deposit Distribution Proceeds

Certain transfer restrictions contained in either the documents relating to the investments and/or with respect to indebtedness at the level of holding vehicles or the investments themselves may prohibit the pledge of Distribution Proceeds. In such circumstances, the borrowers often simply pledge their rights to a collateral account and rely on a covenant requiring Distribution Proceeds to be deposited into such account. This structure is often employed when more direct forms of collateral are unavailable due to such limitations.

The key limitations of the collateral pool consisting of only an account pledge coupled with a covenant to deposit future Distribution Proceeds into such account, and the steps lenders can take to mitigate their effects, include:

|

KEY CONSIDERATIONS |

POTENTIAL MITIGANTS |

|

Limiting the collateral to accounts may also restrict a lender’s ability to recover funds in the event of a default, especially if the pledgor has third-party creditors (e.g., with liens on the equity of underlying portfolio investments that would be the source of any funds deposited into such an account). |

Strong negative covenant provisions (including limitations on incurrence of debts and liens) should be considered to reduce the likelihood of competing creditors. |

|

If a debtor breaches a covenant to direct Distribution Proceeds, lenders would need to sue for contractual damages, which can result in protracted legal proceedings, rather than enforcing a security interest. Furthermore, once cash has left the debtor’s structure, recovery may be difficult. |

Particularly in instances where a borrower possesses a concentrated asset pool, lenders can require borrowers to provide irrevocable notice to a portfolio investment directing such entity to deposit Distribution Proceeds into a pledged collateral account. |

|

In a scenario where there is an insolvency proceeding with respect to the borrower, future payment streams may be viewed as property of the estate (available for creditors generally) and not required to be deposited into a pledged account. |

This legal risk is hard to mitigate, but other protections include strong negative covenant packages that can limit the likelihood of competing claims. Restructuring counsel in each relevant jurisdiction can analyze potential issues that may arise from a pledge of such future payment streams under applicable bankruptcy laws. |

- Covenants Relating to Capital Commitments

In some instances when the loan is made to a fund, lenders may underwrite the loan parties’ uncalled capital commitments, if any, that is available at that time to ensure the creditworthiness of a borrower (even if the lender does not take security therein). In such a situation, the loan parties often covenant to (a) maintain sufficient uncalled capital commitments from their investors to repay any outstanding debt and any downstream capital commitments to investments and/or (b) call capital from their investors during an event of default to repay the lender. While such covenants ensure that the loan parties will maintain an alternative pool of liquidity from which to repay the debt owed to the lender, there are some key limitations and steps lenders should consider taking when relying on such covenants:

|

KEY CONSIDERATIONS |

POTENTIAL MITIGANTS |

|

Investors could have excuse or refusal rights with respect to certain calls, which could reduce the amount of capital contributions the loan parties can use to repay the lender. |

Conduct thorough due diligence on any excuse, withdrawal, or refusal rights of investors under the loan parties’ governing documents, and increase the reserves required to be maintained to account for any excuse or refusal rights. Require the loan parties to maintain other cash liquidity reserves as a buffer to account for any shortfalls in funding of capital contributions. |

|

In a scenario where there is an insolvency proceeding with respect to the borrower, future payment streams from underlying investments may be excluded from the collateral of the lenders by a court in an insolvency proceeding on the basis that such payments are not yet due and payable or are not yet earned at the time of the filing of the bankruptcy petition. |

This legal risk is hard to mitigate, but other protections including strong negative covenant packages that can limit the likelihood of competing claims. Restructuring counsel in each relevant jurisdiction can analyze potential issues that may arise from a pledge of such future payment streams under applicable bankruptcy laws. |

- Negative Pledge Covenants and Springing Collateral Arrangements

Lenders can often include a strong negative pledge (i.e., a covenant that prohibits the borrower from pledging its assets to another party) or double negative pledge (i.e., a covenant that goes further than the standard negative pledge by also requiring the borrower to abstain from granting any other negative pledges to third parties) in the loan documentation. This approach helps safeguard the lender’s interests by ensuring that the borrower should have sufficient unencumbered assets to repay the lender.

The primary potential drawback of relying solely on a negative pledge covenant in the absence of other collateral is that the lender has unsecured exposure and must ensure compliance with the negative pledge through strict and ongoing monitoring of the borrower’s debt and assets. This may potentially impose additional administrative costs on the lender and the borrower. Furthermore, while a covenant can provide some protection to lenders, it does not provide the same level of protection as being secured by collateral, especially vis-à-vis third-party creditors. Lenders must carefully balance the benefits of relying on a negative pledge covenant with the potential constraints and operational implications of such an approach. Lenders should be aware that negative pledge covenants, while useful, do not provide the same level of protection as direct security interests.

A key mitigant to these concerns can be a covenant requiring borrowers to pledge collateral if their LTV ratio falls below a certain threshold. Lenders get comfortable with such arrangements because the borrowers’ assets would be kept available through use of the negative pledge, and if the borrowers’ financial performance drops, the collateral would spring into place to protect the lenders. This is especially preferable where taking security interest in the intended collateral is laborious or cost-intensive (e.g., in cases where the intended collateral consists of real property).8

If employing such an approach, lenders should ensure that strict financial covenants and reporting are used to monitor fund performance. Covenants requiring specific staggered LTV ratios can also be used to require borrowers to seek consents from the sponsors of pledged assets or make repayments well in advance of a default.

- Guaranties and Equity Commitment

Lenders can also look to a financially viable parent entity or investor of such borrower to financially backstop such borrower’s obligations. This support typically comes in the form of either a guaranty or an equity commitment.9

A guaranty is an agreement by a financially viable parent entity to support the repayment of a borrower’s outstanding obligations to a lender. Guaranties can come in many forms, including (a) payment guaranties, whereby a lender may seek payment directly from the fund without any obligation to first seek payment from the borrower; (b) collection guaranties, under which a lender must exhaust its remedies against the borrower prior to seeking payment from the fund; and (c) “bad-boy” guaranties, whereby payments from the fund will only be required if the lender’s losses result from certain bad-acts or misrepresentations of the guaranteed borrower.

Often, however, a guaranty is not a viable solution as it counts as debt on the books and records of the fund. As an alterative, however, parent funds will often provide an equity commitment to a NAV borrower (either directly in the NAV borrower’s constituent documents or via an equity commitment letter). Unlike a guaranty, which is made in favor of a lender and where the fund is a direct counterparty of a lender, relying on an equity commitment borrows the collateral structure of a traditional subscription facility (i.e., the borrower pledges its rights to call, enforce and collect on the parent fund’s equity commitment). Any approach using an equity commitment should focus on the same “key” provisions that are required for subscription credit facilities (i.e., the obligation to fund without setoff, counterclaim or defense, having the lender being an express third-party beneficiary, etc.), and when structuring equity commitments, careful attention should be paid to ensure they are enforceable and provide meaningful recourse to the lender.

Conclusion

The diverse collateral and restrictive covenant options available in NAV credit facilities present both opportunities and challenges for lenders and borrowers. NAV lenders may be able to leverage different forms of collateral, such as equity interests, payment streams, and deposit accounts, to secure their loans while borrowers can access needed liquidity without disrupting their investment positions. A thorough understanding of the benefits and potential challenges associated with each form of collateral and restrictive covenant is essential for successfully structuring NAV credit facilities. Lenders must carefully assess the unique characteristics of each deal, the borrower’s financial health, indebtedness that may exist that may pose restrictions, and the asset pool’s nature and limitations to determine the most effective combination of collateral and covenants.

Ultimately, the key to a successful NAV credit facility lies in the flexibility and customization of its structure. By tailoring the collateral and covenant package to the specific circumstances at hand, lenders can mitigate risks and borrowers can achieve their financing goals. Both parties should engage in ongoing dialogue and due diligence to adapt to changing market conditions and ensure the long-term success of the facility. NAV credit facilities offer a powerful financing tool for sophisticated investors, provided that both lenders and borrowers are well-versed in the intricacies of collateral structures and restrictive covenants. By staying informed and agile, market participants can navigate the complexities of NAV credit facilities and capitalize on their potential benefits.

As the NAV credit facility market continues to evolve, we anticipate further innovations in collateral structures, potentially including increased use of hybrid structures that combine elements of traditional NAV and subscription line facilities.

1 For information on NAV credit facilities generally, see “The Advantages of Net Asset Value Credit Facilities”

2 Often, if the borrower is a subsidiary aggregator vehicle of a larger fund, lenders will seek an equity interest in the borrower itself, accompanied by a guaranty or other fund-level recourse, such as the right to call capital form the fund.

3 For more information on double negative pledges, see “Double Negative Pledges in NAV Credit Facilities: What Fund Finance Lenders Need to Know”

4 In light of certain jurisdictional differences, the granting language with respect to the security interest in the equity interests should be explicit that such interests include all related economic rights, voting, management and control rights, and the right to be admitted as a member or limited partner (as applicable).

5 Bank lenders should be prepared to address any Volcker Rule-related concerns to the extent they determine to hold or control the equity themselves. Additionally, consents to transfer and foreclose may need to be obtained depending on the type of investment held by the borrower.

6 If structured as a limited partnership, this would include a pledge of both the limited partnership and general partnership interests in such entity.

7 Private equity funds almost always include restrictions on the rights of an investor to transfer their equity interests to third parties. Those restrictions typically take the form of a general prohibition on sales to third parties without the general partner or manager’s prior written consent, but may also include restrictions on the ability of an investor to pledge their equity interests (or the economic rights arising from such equity interests).

8 Note, however, that one potential downside to this approach is that, in the event of subsequent bankruptcy or insolvency proceedings, applicable lookback periods (such as the 90-day or one year lookback period for preferential transfers under the U.S. Bankruptcy Code) typically will run from the time of grant and perfection of the springing collateral rather than the date of the initial agreement.

9 For more information on the differences between a guaranty and an equity commitment letter, see “Equity Commitment Letters: Understanding How They Differ From Guaranties”